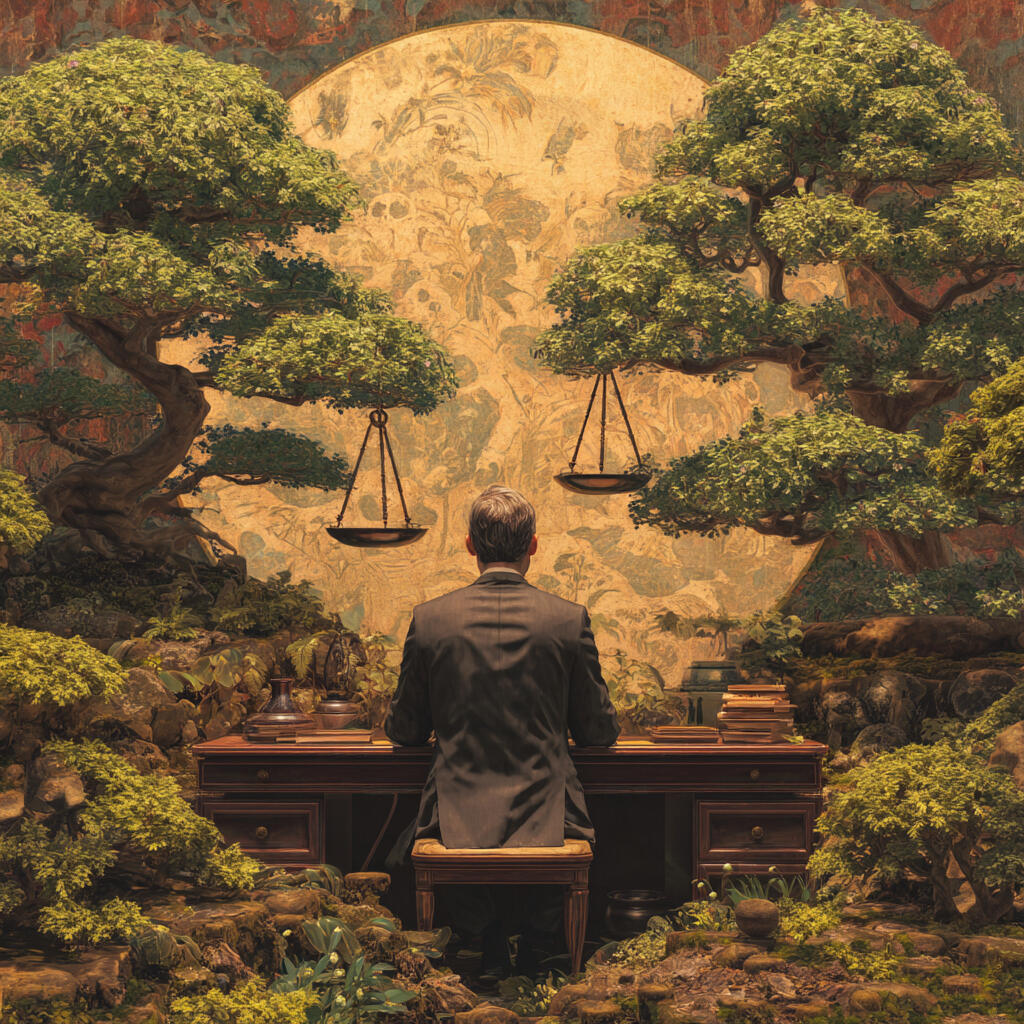

Legal help for routine legal problems.

No law degree required.

Zen Legal helps you make sense of the paperwork,

understand what happens next,

and get the standard forms—

to help you handle routine legal problems...

without the $500/hr translation fee.

How It Works...

Your Legal Path, Simplified.

Housing & Property

Rent hikes, deposits, repairs, or evictions

— understand your rights before you get steamrolled.

Just clear guides...

...you can actually use.

Work & Wages

From missing paychecks to workplace disputes

—know the rules and the steps that matter.

Work & Wages

From missing paychecks to workplace disputes

—know the rules and the steps that matter.

No jargon.

No surprises.

Family Basics

Custody, divorce, or protective orders

— tough issues, handled with clarity (and humanity).

Disputes & Small Claims

Suing or being sued?

Learn the basics, prep your paperwork, and walk in with confidence.